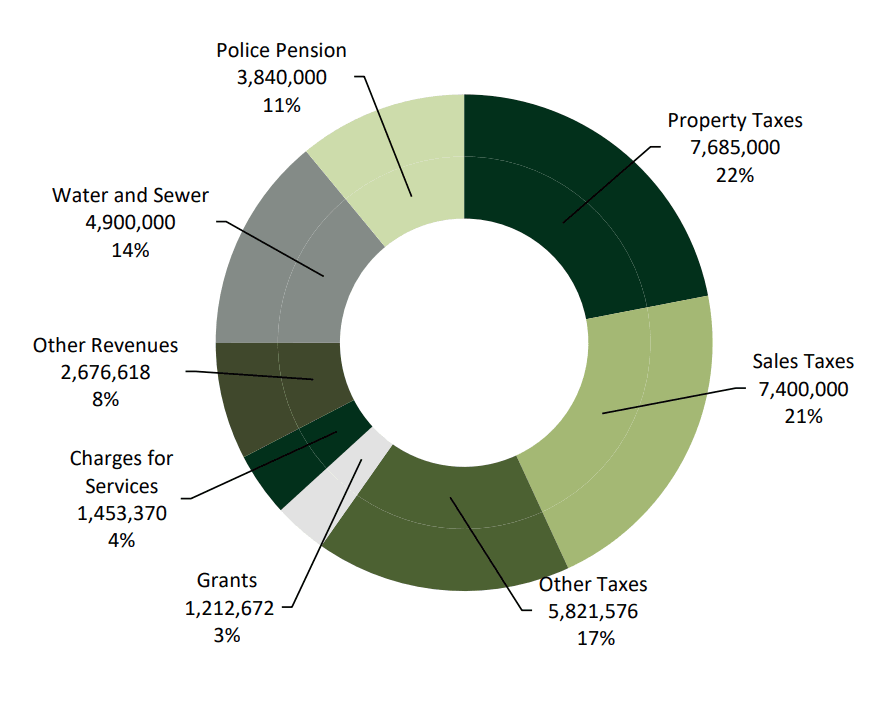

Revenues

The Village uses several sources of revenue to fund government operations. The largest source of revenue for the Village is Property Tax, which accounts for 22% of the total revenue received. The revenue the Village receives is allocated in the following manner:

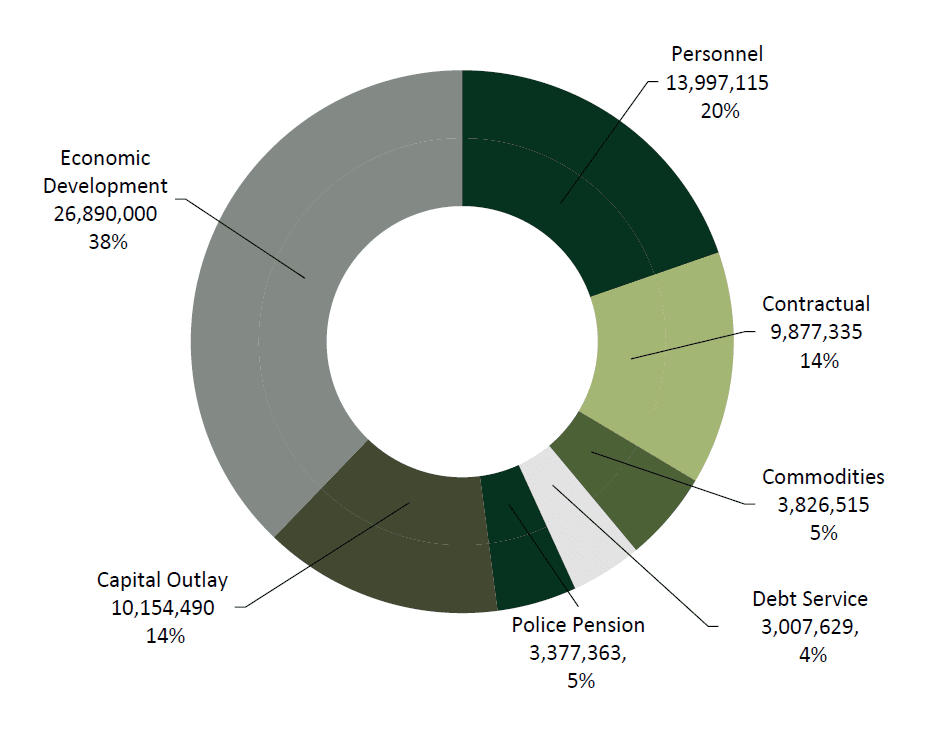

Expenses

The Village allocates expenses in the following manner:

An additional 2% tax is collected on the purchase of prepared food and beverages, resulting in a total tax of 12% on these purchases. As of June 1, 2021 the prepared food and beverage tax was increased from 1% to 2%.

Utility Taxes

The Village's natural gas and electricity utility tax rates are 5%. Find more information regarding utility tax rebates for elderly and low income residents.

The simplified municipal telecommunications tax rate is 13%, 6% of which is allocated to the Village and 7% is allocated to the State of Illinois.